UBSAdviceAdvantage

End to end design process, including discovery, research and testing for a Robo-Advisor system serving Emerging Affluent consumer

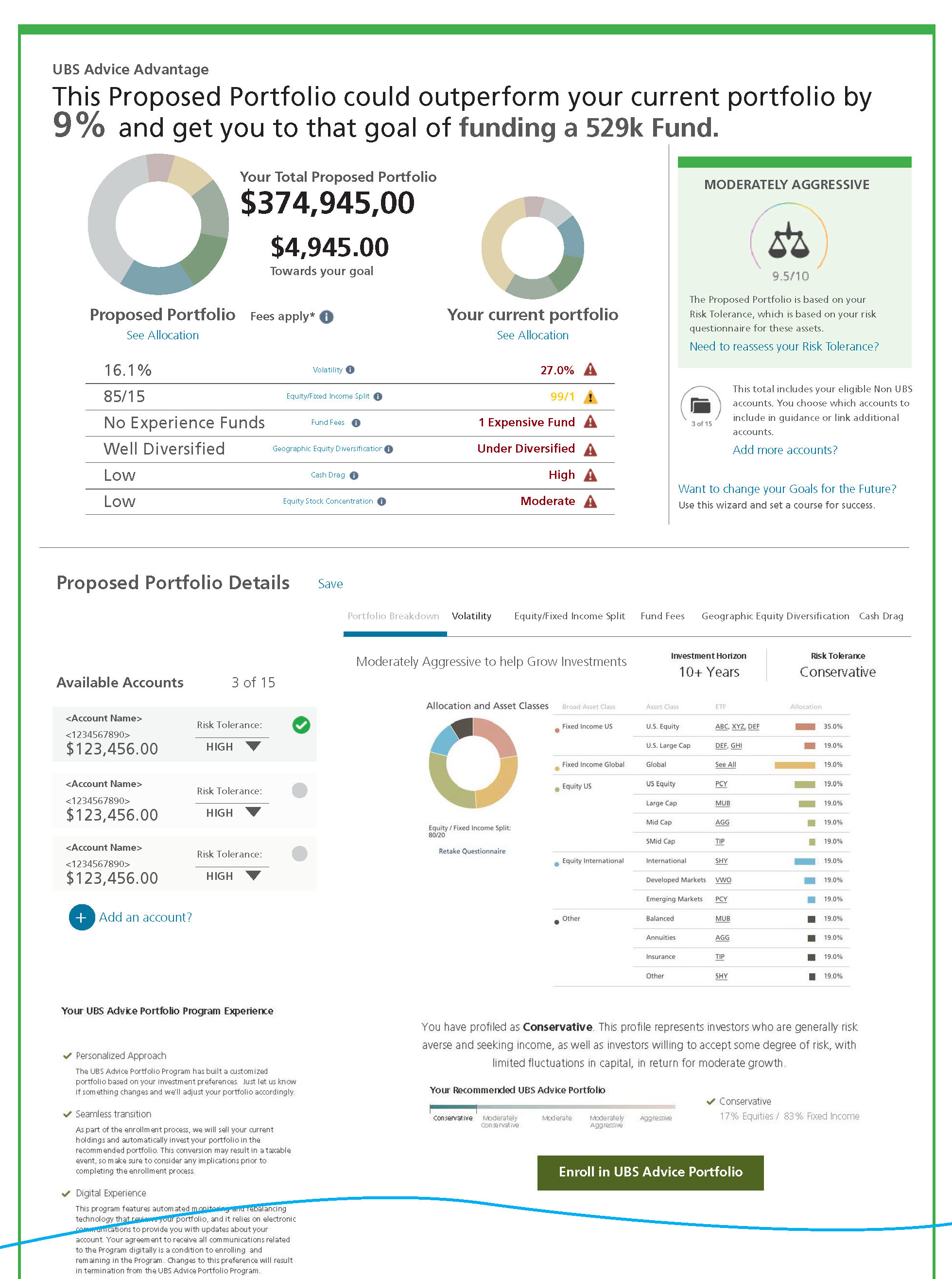

Initial Design of the Consumer Facing Experience

What’s is UBS Advice Advantage?

Responsive desktop based tool for addressing the investment needs for the Emerging Affluent Consumers, it analyzes and provides insights on clients investment accounts, even those outside of UBS. The platform incorporates research and market views in the diagnostics and portfolio construction.

The problems

Emerging Affluent users, an untapped market, need an alternative investment vehicle geared to their asset level and investment philosophy as well as their technological preferences.

My Role

I was responsible for managing the discovery process, including research, strategy and overall hands-on design of the material and artifacts. I led the work on all deliverables and artifacts in Axure using Lean UX and usability testing, presenting these to the client and key stakeholders.

The platform was also customized to incorporate UBS research and market views in the diagnostics and portfolio construction. An opportunity to enhance the advisor-client relationship with an innovative product that meets clients’ needs and maintains the critical elements and trust we have cultivated over decades.

What is UBS Advice Advantage?

Guidance on your overall financial picture

UBS Advice Advantage analyzes and provides insights on your investment accounts, even those outside of UBS.

Find out if your current portfolio is aligned with your view on investment risk. Understand areas where you may want to make changes—like cash drag and equity stock concentration. And get our perspective on how you could improve your investment strategy.

Make goal-setting a priority

The ability to set goals is just one of the features available to you through UBS Advice Advantage. Link accounts to your goals and view details from your UBS Online Services home page.

Bringing it all together:

UBS Advice Portfolio Program

The UBS Advice Portfolio Program is an asset-based fee advisory program that blends the power of the firm’s investment philosophy with intelligent technology—customized to your preferences—so you can focus on other important things in life. You also have ready access to UBS Financial Advisors, who are just a call away.

Build your customized portfolio

Enrolling your accounts in the UBS Advice Portfolio Program gives you access to a customized approach based on your investment preferences. It’s built on smart technology and powered by the insights of UBS.

Regular monitoring

Your portfolio will be monitored daily, and we'll make any needed adjustments to help keep your investments aligned with your preferences and risk tolerance.

Tax-efficient investing

Add the tax harvesting feature to your portfolio to help you manage your tax exposure.

Support from UBS Financial Advisors

Contact your team whenever you have questions or need guidance.

Discovery

Because of the KPIs we assembled, and the assumptions of the business partners we determined we needed to use methods to identify user needs, explore new opportunities, validate existing assumptions, and generate new ideas.

Interviews with internal stakeholders, SMEs, and users

Financial Analysts

Office administrators

Contextual interviews

Persona development

Problem statement

Financial analysts and their support staff need a more responsive desktop based tool for addressing the investment needs for the Emerging Affluent Consumers. They need analysis and insights on clients investment accounts, even those outside of UBS. The platform should incorporate research and market views in the diagnostics and portfolio construction.

We found that users wanted an experience that guided them through core processes of specifying goals and risk tolerances, custom portfolio construction, and quick on boarding, coupled with smart hand holding to move freely through a streamlined process.

“As a user I want to compare different goal scenarios, and determine, maybe through a data viz, the differences between each. I need to connect to a real person to understand what’s going on though”

What we learned in testing

Surfacing of portfolio criteria

Dynamic data visualizations

New navigation concepts

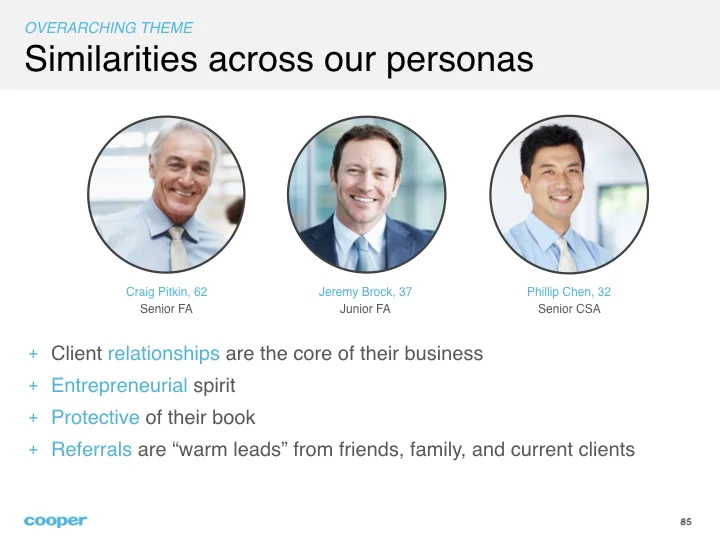

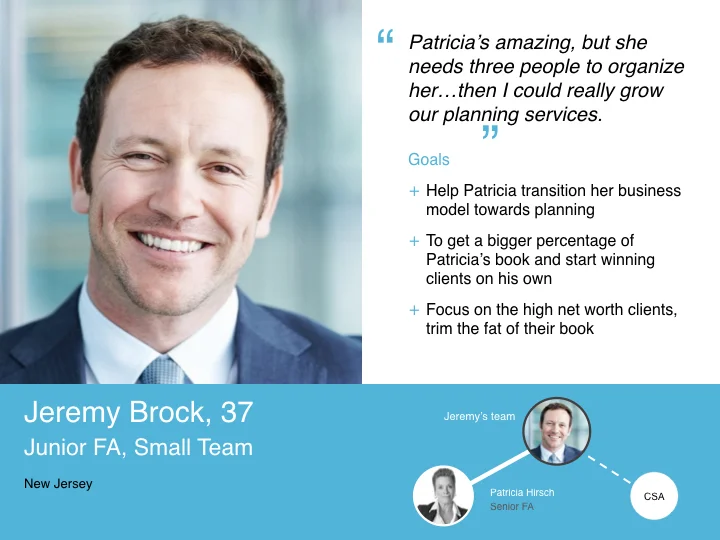

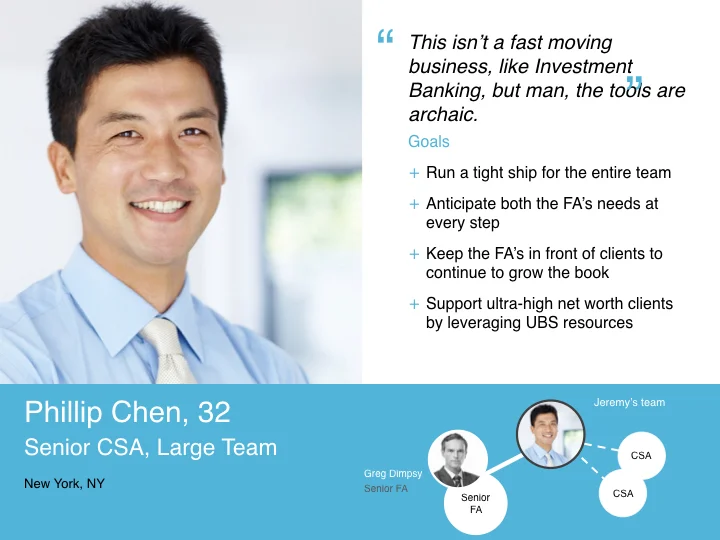

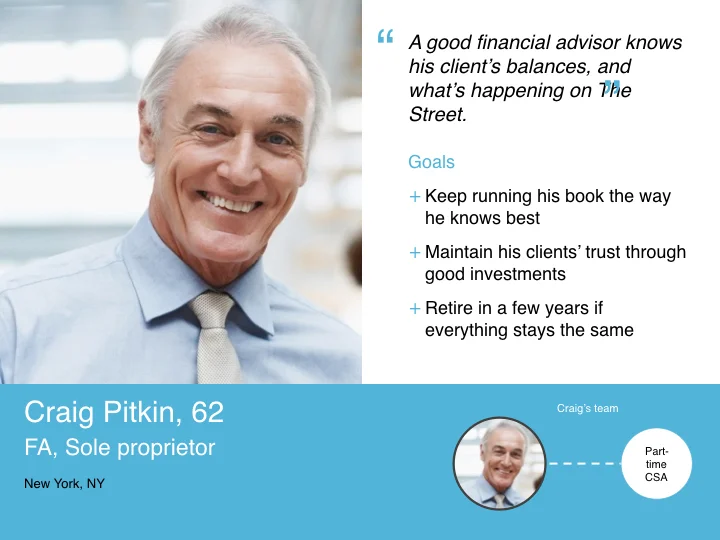

Personas

Several personas were developed from the original Discovery exercises to showcase the needs of the users. The main users would be Emerging Affluence, then secondarily, Established Affluence, and Late Bloomers.

The Emerging Affluent are defined as those aged 21-49, with investable assets of $50,000

to $250,000 and a household income of $100,000 or more.Established Affluent is based on the definition by income and by investable assets, a net worth of between $500,000 – $5,000,000 in net worth. It’s very hard to have investable assets of $100,000 – $1 million if you don’t have a net worth of $500,000 – $2,000,000

Late Bloomers are separated from either persona by the fact they have less than $100,000, in assets, and are over the age of 50 years of age.

The Delivered Solution

Understanding, iterating, validating. That’s the design-thinking actions that were established in all our engagements. Discovery of the personas and user journeys, concepts, and validation of those concepts. Design engagements and iterative validation through usability. We engaged, interviewed and shared focus groups and design exercises with stakeholders, users groups, financial analysts, CSAs, tech leads, and data scientists, and got into their heads. Collaborative design exercises with consumers, stakeholders, mapping out their process and the technical touchpoint was integral to establishing the architecture of data, actions, and information. Translating their business and user needs laid out the strategy. We built a roadmap for design processes into the Lean UX cycle and Agile environments.

• Feature refinement and road map

• 12 Agile-based sprints

• Usability testing on regular cadence

• Demos and QA

Lead design-thinking exercises

Conduct user research studies, user-testing, A/B testing — utilize the results to improve the customer and user experience

Develop user scenarios, user flows, interaction models, wireframes and prototypes to create the ideal user experience — all within specified guidelines and deadlines

Planned and lead Customer/Partner UX meetings

Participate in agile scrum meetings

Work directly with PM teams to ensure that designs reflect user experience need

Assess and optimize the performance of new and existing features by conducting/participating in usability testing and interpreting analytics data

Work across functional teams to understand business and feature requirements UBS Advice Advantage — A Consumer-facing Robo-Advisor Experience

TASK FLOW ANALYSIS

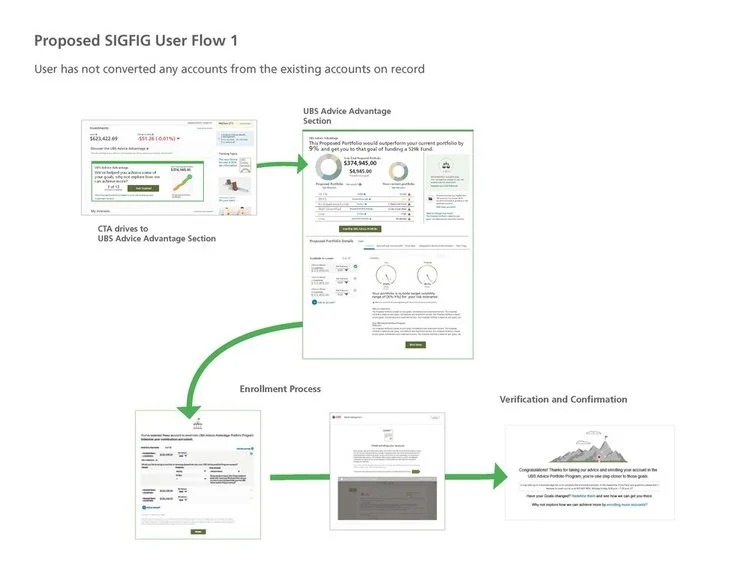

USE CASE 1 USER FLOW

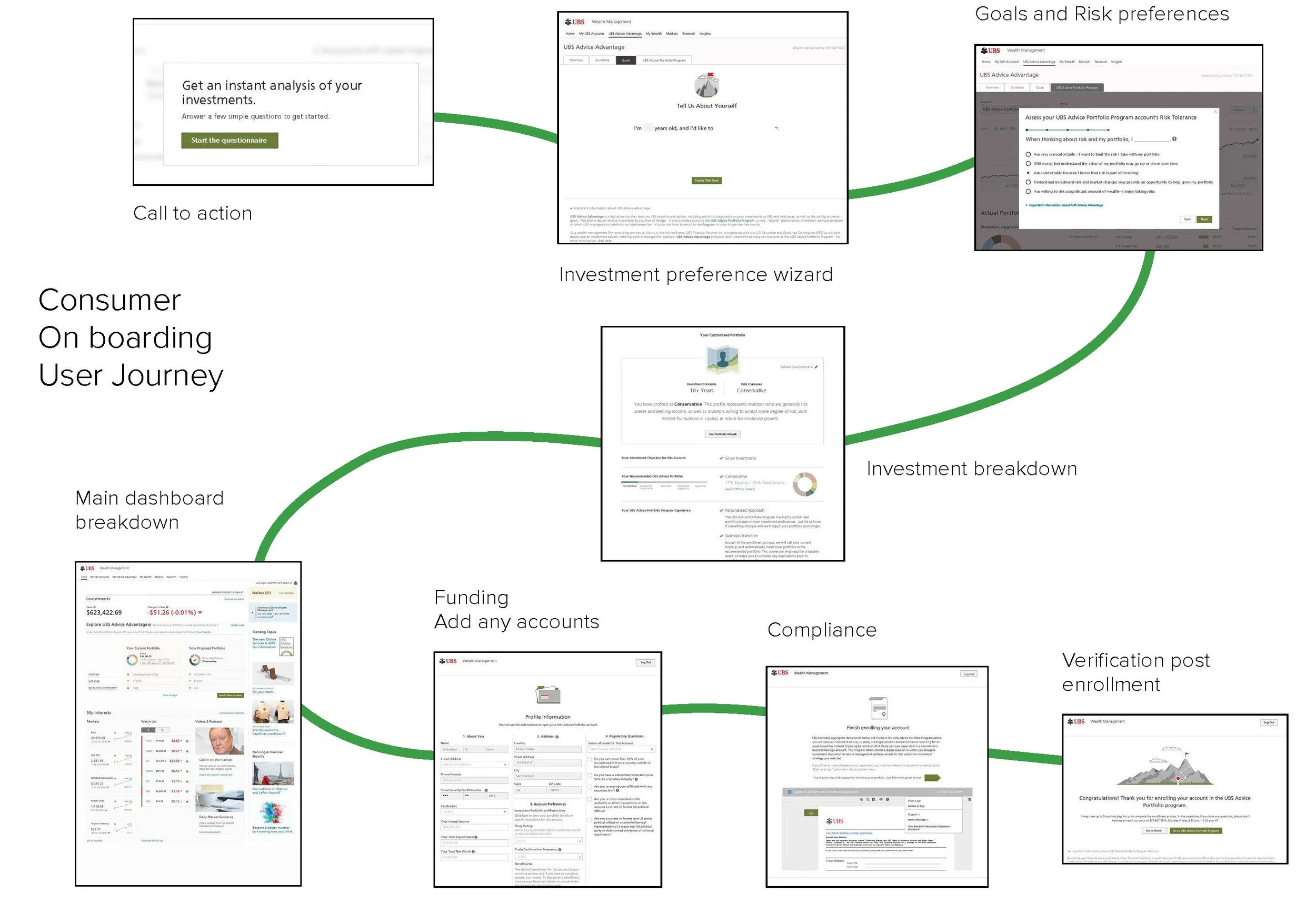

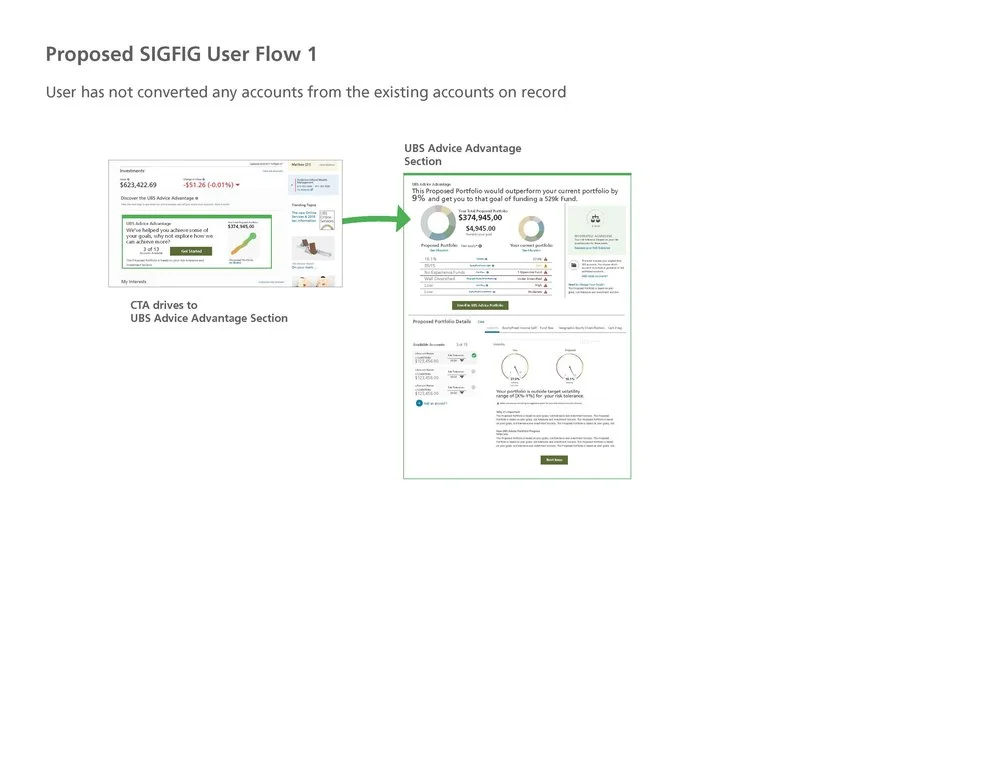

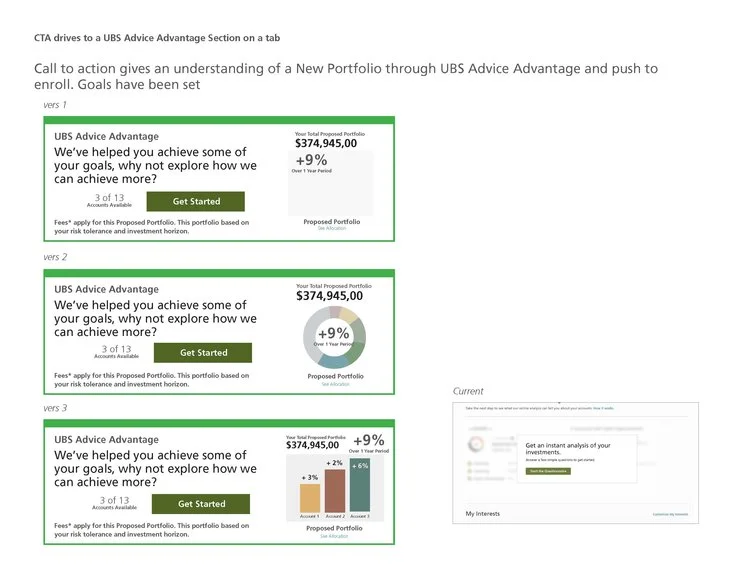

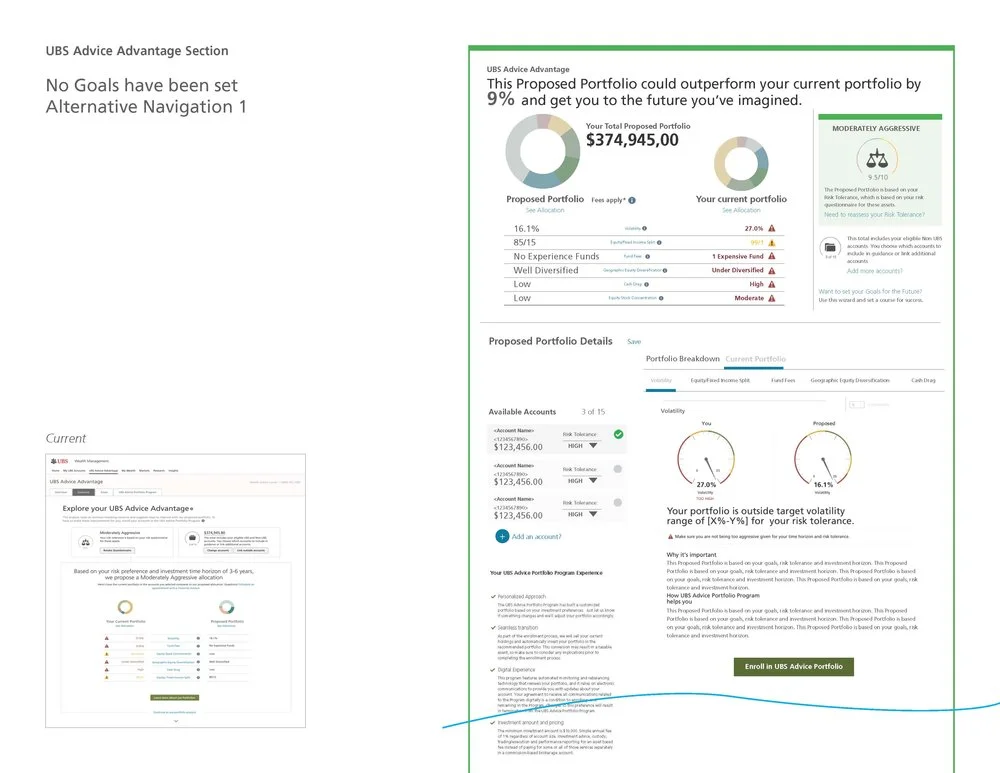

The basic process of UBS Advice Advantage includes a definition of goals, risk, and timeframe. Through a CTA on a consumer's OLS Homepage, they can access the marketing materials, and understand the unique proposition, establish goals, maintain a risk level and fund their accounts.

CALLS TO ACTION

BROWSER-BASED EXPERIENCE MAIN FEATURES

USE CASE 2 USER FLOW

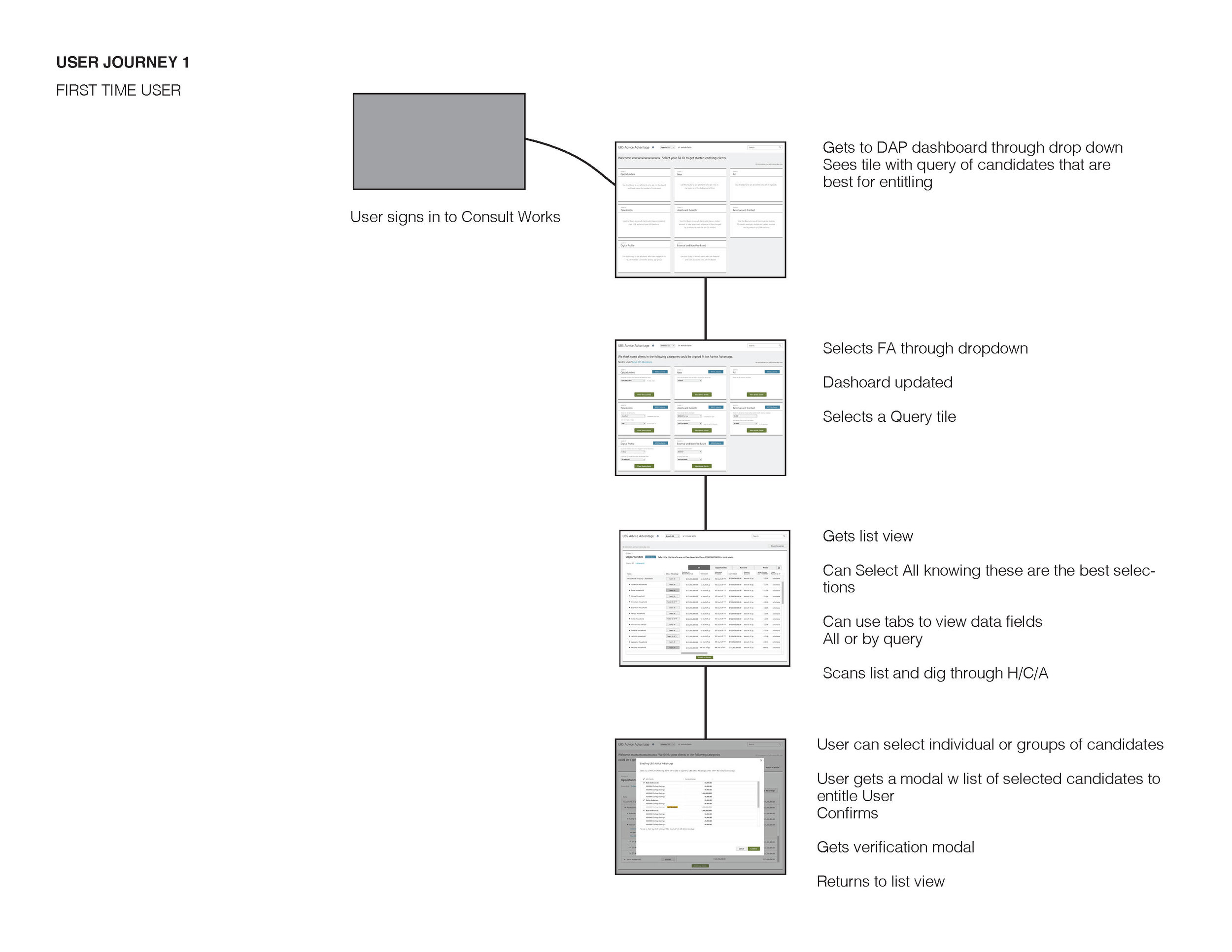

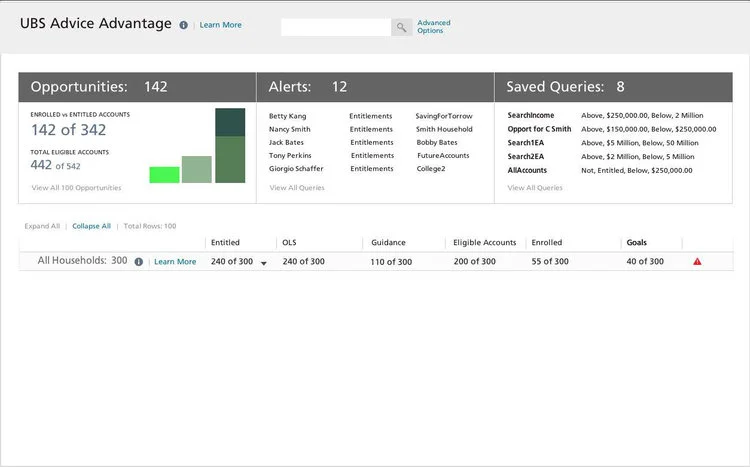

DAP Dashboard for UBS Financial Analysts

– Partner Facing Experience

End to end design process for design and development process for desktop-based entitlement platform.

THE PROBLEM

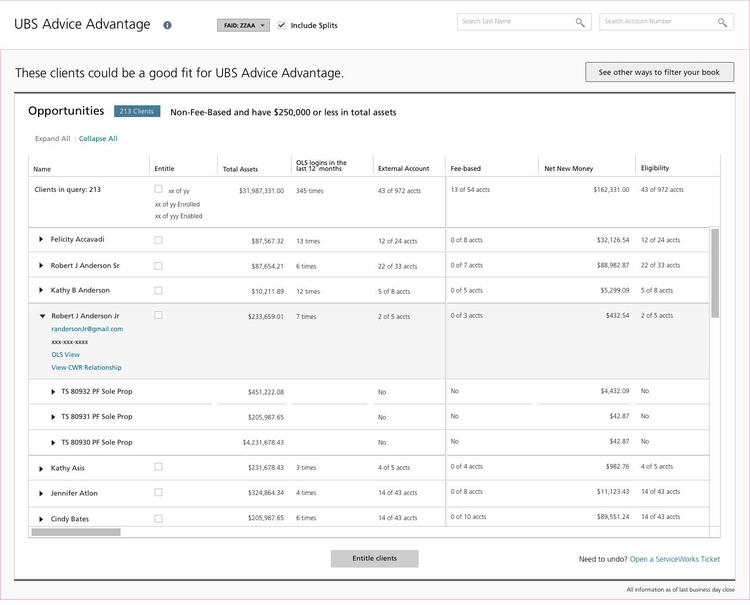

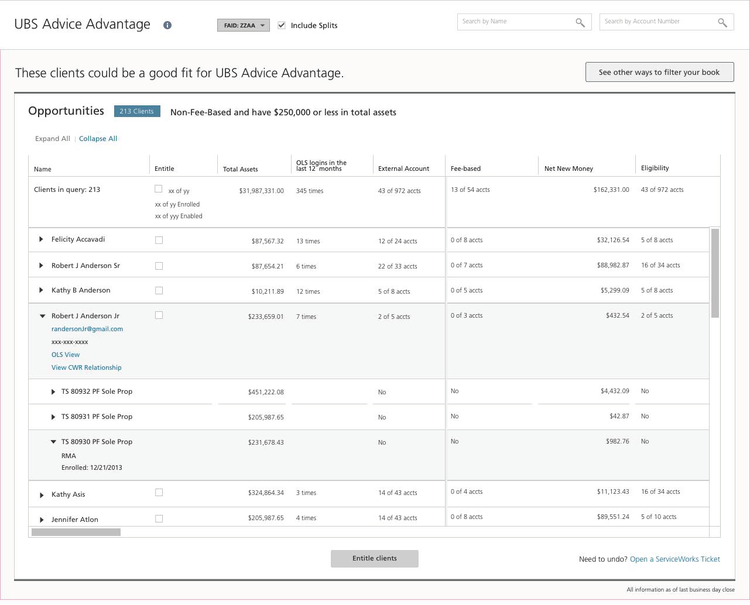

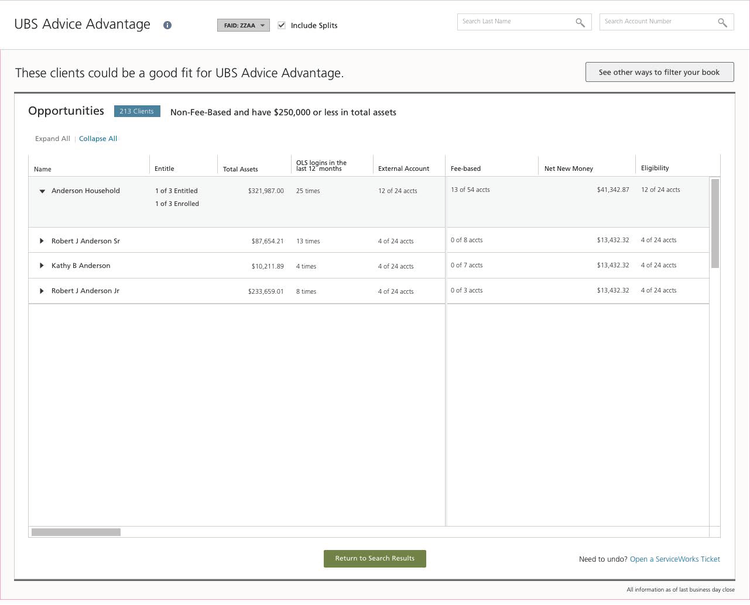

Financial analysts need a place to understand and entitle their affluent clients who would be eligible for the UBS Advice Advantage platform and its services.

OUR SOLUTION

The DAP Dashboard Experience allows FAs and CSAs to entitle any of their clients they feel would benefit from enrollment onto the UBS Advice Advantage Program. A User can search and find clients, understand a clients relationship to a household, and related clients, understand accounts related to a client, entitle any client they feel would benefit. The Field SigFig MVP will require a new set of pages to display UBS Advice Advantage details to the Field and Home Office users. Existing ConsultWorks applications may need to be modified in order to be a part of the Advice Advantage process.

UBS Advice Advantage is UBS’s first platform designed with SigFig, an independent San Francisco-based wealth management technology company. The firms worked closely together to integrate the service within the UBS Online Services client website. The platform was also customized to incorporate UBS research and market views in the diagnostics and portfolio construction. We saw an opportunity to enhance the advisor-client relationship with an innovative product that meets our clients’ needs and maintains the critical elements and trust we have cultivated over decades.

What we learned from our discovery interviews:

“I know my book of business, if I could easily same time and use this app, I could focus on the high level clientele I have, that makes my year”

FINANCIAL ANALYSTS USER INTERVIEWS

Interviewees: Angus M., Geoff M., Ted B., Kevin R

Interviews Take Away Summary:

Strong agreement that the redesigned platform should primarily be an enabler of FA/Client relationships

“The Next Conversation” – enable better targeting of relevant topics to drive both quality and quantity of interactions

Equip the FA with an information advantage, pushing client education past plan creation

Clarification of “white glove” vs. “premium” terminology in the context of the platform

Premium experience should come by way of the advisor, not the platform

Not a self-serve business; FA already knows client and his/her needs deeply, wealth management should be the filter

Role of UBS brand is to strengthen relationship between firm and client

Delta of relationship, relevance and product potentially results in higher share of wallet for UBS

Mitigating calls for help and strengthening FA’s intellectual advantage work together to strengthen affinity for UBS

Custom-built-from-scratch Queries might be a functionality needed by some power-user level FA

Charts might not be a major need for day-to-day FA operations, but could be useful at Supervisory levels

Entitling large groups of Households might not be needed

Confirmed it will be Client Level only

Categories/tiles of groups is an important concept

These categories need to be defined

Need to understand clients children, millennials in regards to WAC and prospective accounts, (get the children in the funnel, convert)

List view, FA selector mandatory needs verified

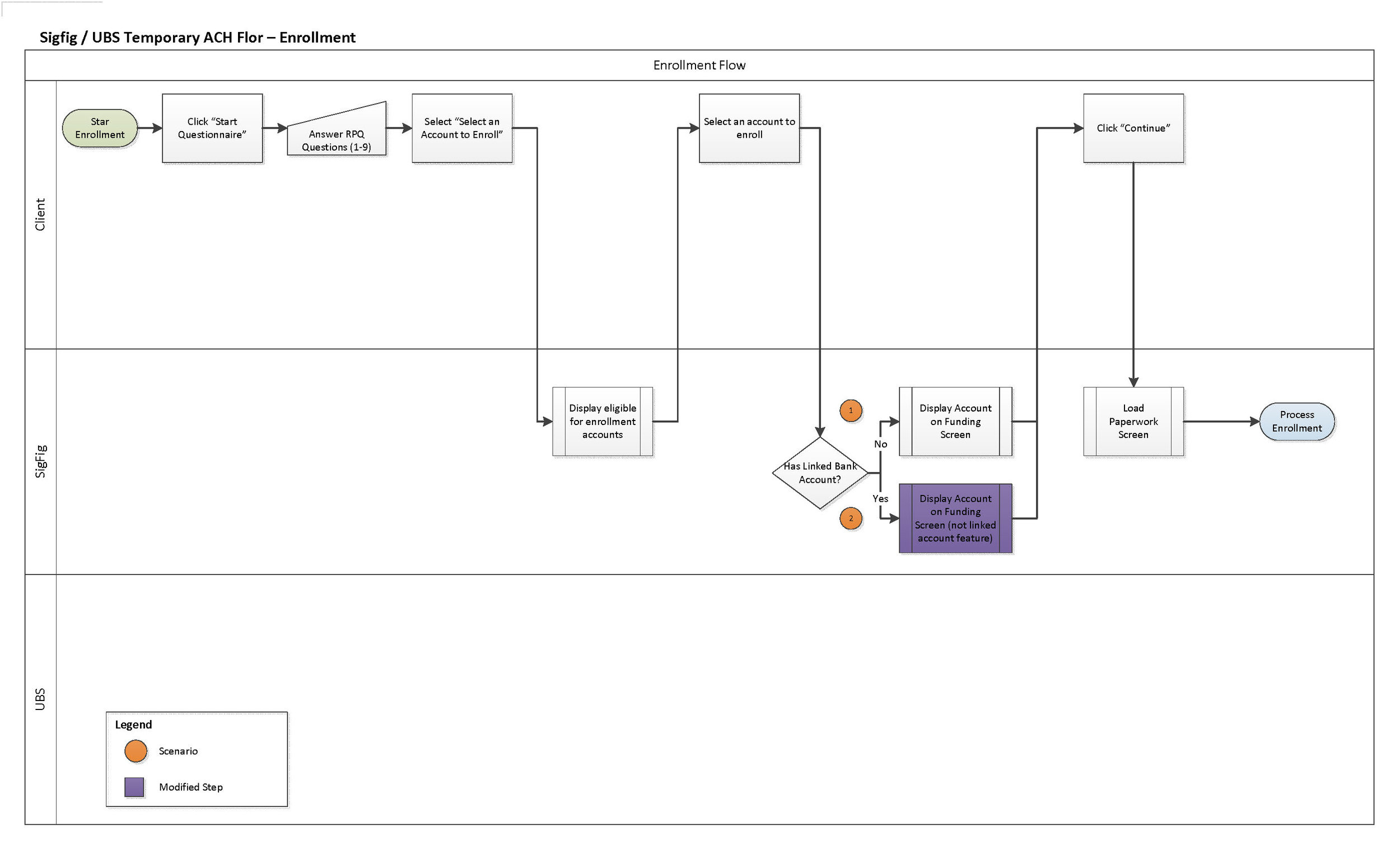

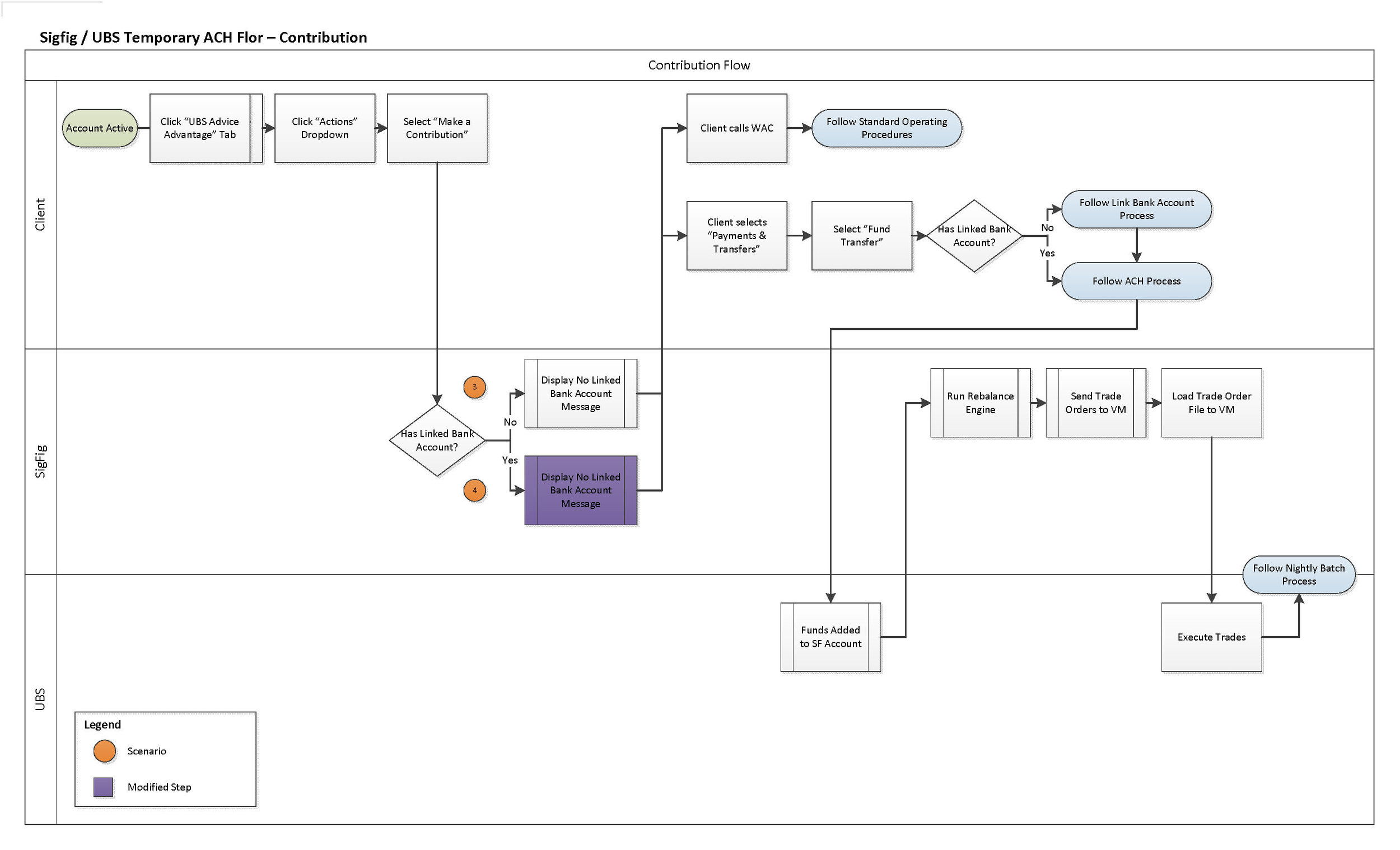

PROCESS MAPPING

We mapped out the back-end technical actions and their relevance to the front end processes. Enrollment, Contribution and Withdrawal journeys were mapped. The major flows were for Enrollment, Contributions, and Withdrawal of Funds. we learned about the flow of data and the intricacies of how users diid their tasks.

Enrollment Flow Map

Contribution Flow Map

Withdrawal Flow Map

USE CASE SCENARIOS

Platform deficiencies have a unintentionally created an additional task flow for FAs and CSAs: “Construction”

Meaningful chunks of time spent gathering materials from disparate sources for the sake of putting together relevant artifacts for clients!

Legal disclaimers and information overload in UBS client materials are barriers FAs feel they must overcome!

Feeling of being held to what information UBS wants in account views and presentations!

Creation of custom Excel templates for client presentation is a common activity!

Easier access to ready-made, digestible, and relevant materials that can be manipulated for client need is desired!

Some FAs feel as though they are “beating the system” by creating their own templates !

FAs and teams have plenty of workarounds, but don’t necessarily like them!

Outlook, Excel, file folders, binders all help mitigate inconveniences, but shouldn’t be looked to as real solutions!

Re-architecting prospect input, client lookup, and client view would fix majority of problems! Business management not reflected as a platform priority!

Early-morning activity, seen as relatively straightforward!

Little communication of desire to model performance based on other FA teams !

Relationships

The FA has no linear user journey when it comes to client relationship management!

Prospecting can take years; input and action occurs in spurts, platform needs to address this reality!

“Inbox Karate” – ability to focus on an individual client affects performance, but task management can be asymmetric.

FAs have had success getting clients to think about banking and investment holistically, but platform support impacts this thought process!

Lack of consistent, real-time account information leads to consternation as well as panic for clients!

Transacting across related, linked and/or outside accounts can require days of manual input, in conflict with client expectation!

Analog interactions remain a consistent reality!

Onboarding materials, meeting collateral, note taking, and task management all still frequently manifest on paper!

Lack of automated systems (i.e., easy to use e-signature or account aggregation tools) hamper even tech-savvy FAs!

ADVICE ADVANTAGE PERSONAS

Collaboration

Future FAs work in a team/advisory structure; platform needs to support leveraging of 4-5 different skills in one team

Differing schools of thought on whether attention should be directed at FAs, CSAs, or both

Vision

CSAs manage tasks and use platform more often

Design choices needn’t be mutually exclusive

“Documentation” (collateral, status, transactions, etc.) is the key to powerful collaboration

Behavior

Emphasis on FA individuality and entrepreneurship has typically translated to customization on the platform, but FA behavior does not reflect a desire to customize

Need to support each FA individually remains, but the focus should be on leveraging technology to drive behavior

Delivering on the goal of the desired user experience will drive adoption

DASHBOARD EXPLORATIONS

Transformative:

• Not interested in incremental changes, looking for a generational leap

• A singular focus on UHNW client and advisory FA role

• Willing to consolidate/jettison features outside of focus

Pragmatic:

• Seeking design leadership plus incremental improvement

• Oriented toward both future FA’s and current-state efficiency

• Looking to leverage existing features/tools responsibly

Defensive:

• Enabling FA business growth gives them a reason to stay

• Efficiency and flexibility in entrepreneurship are digital priorities

Wish List

“Alert Engine” – one place for alerts to be proactive!

Social Functionality – the ability to create “social signals” for prospecting, communication, and relevance!

Ability to target, track, action, and give feedback to an idea/opportunity!

Incorporation of UBS International ability to give the client a health check on portfolio and provide recommendations + advisor contact!

OVERALL USER TASK WORKFLOW

USER JOURNEY 1

HIGH FIDELITY WIREFRAMES

LOW FIDELITY WIREFRAMES

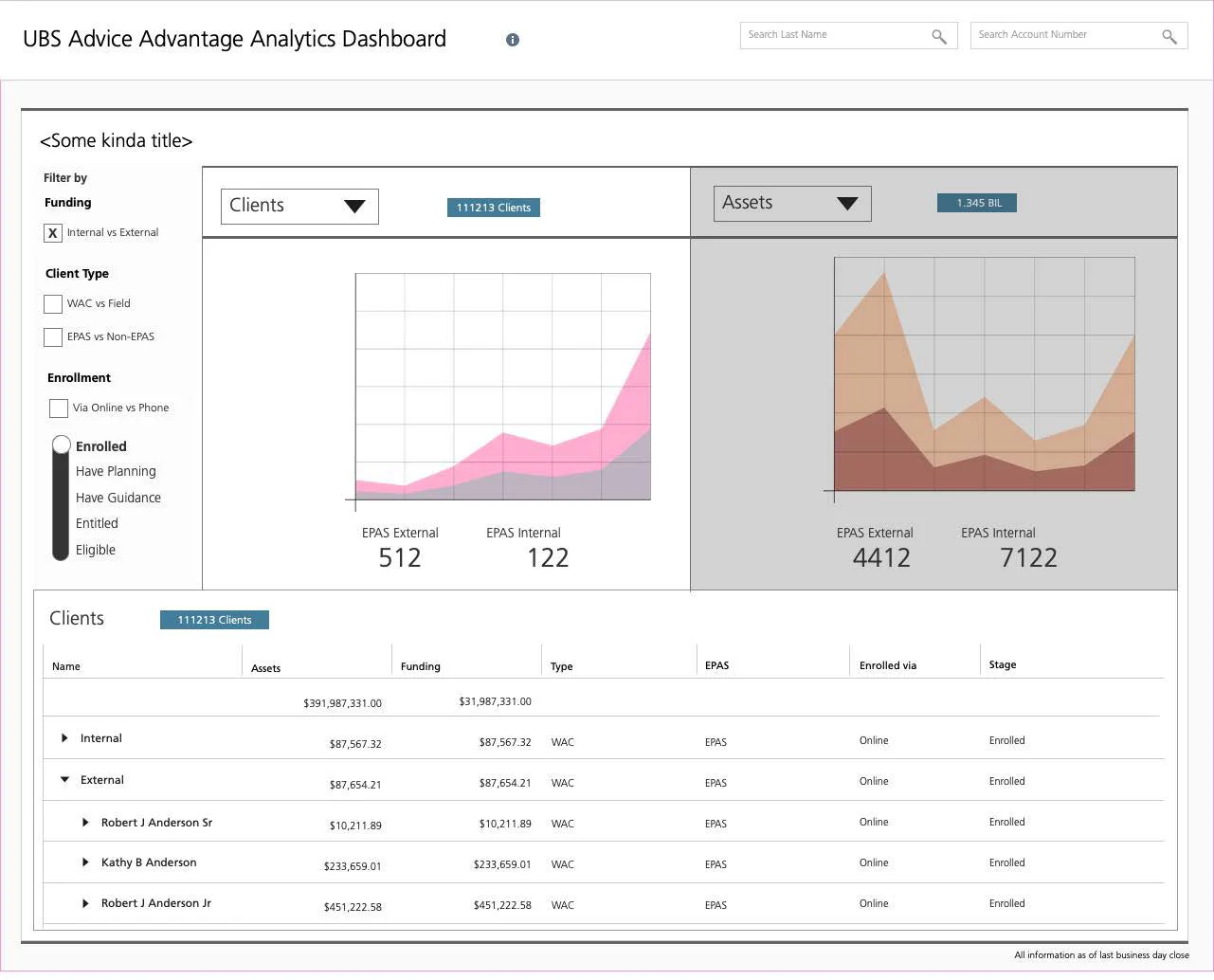

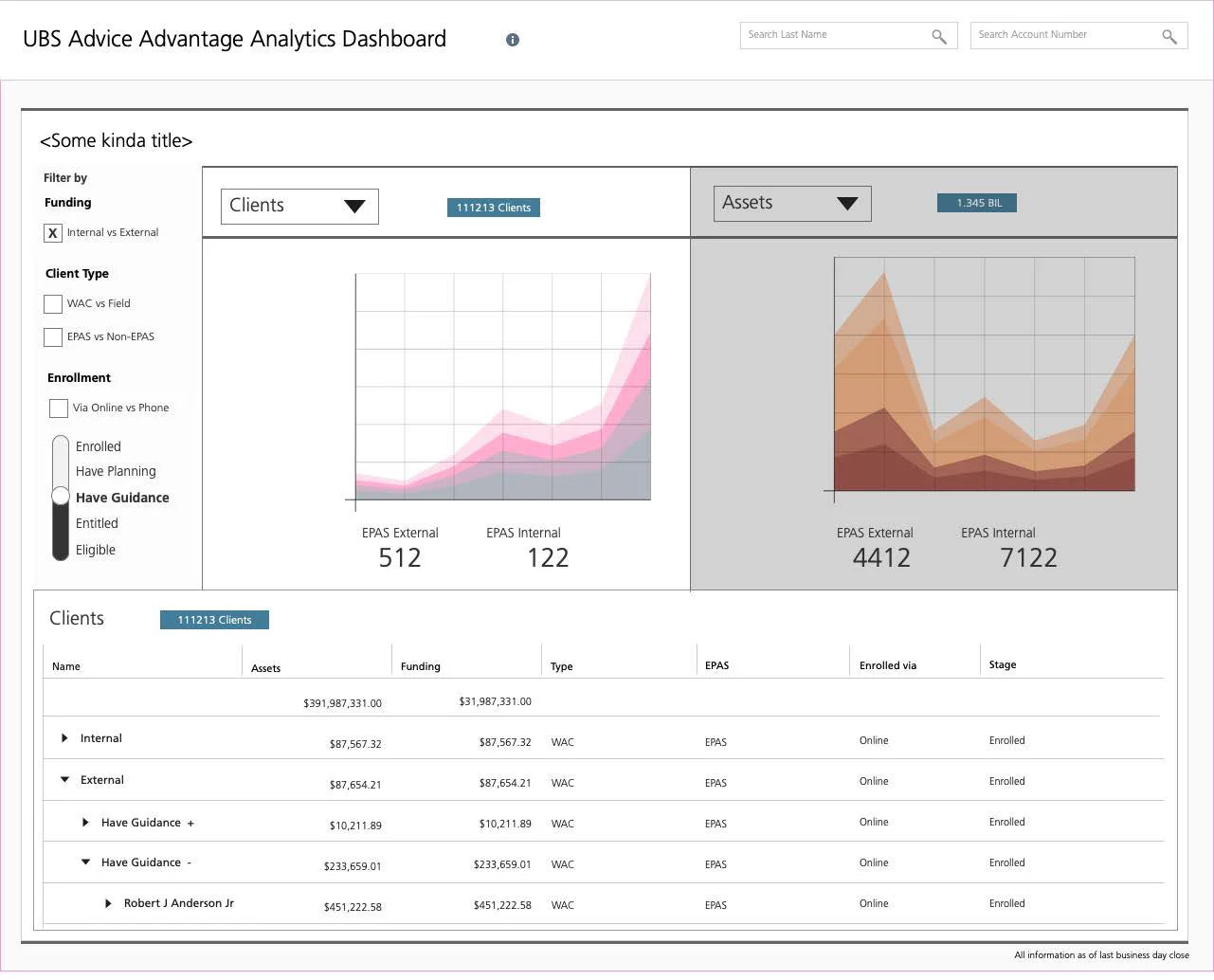

DATA VISUALIZATIONS

We investigated the options of each data visualisation form and tested them with users as to their understanding of the data.

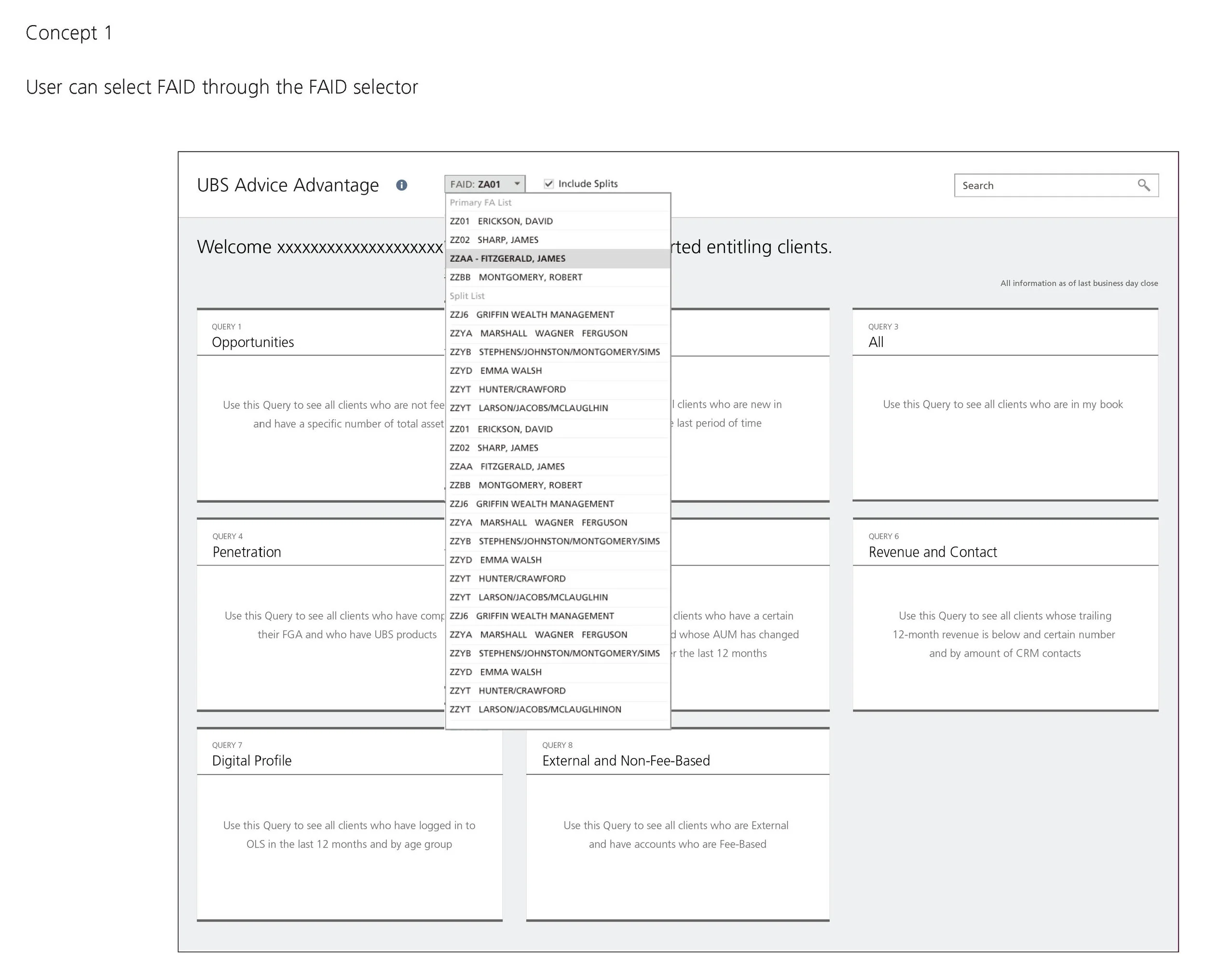

QUERY BUILDER

Design executions on a query builder for FAs to find the clients they want to focus on.

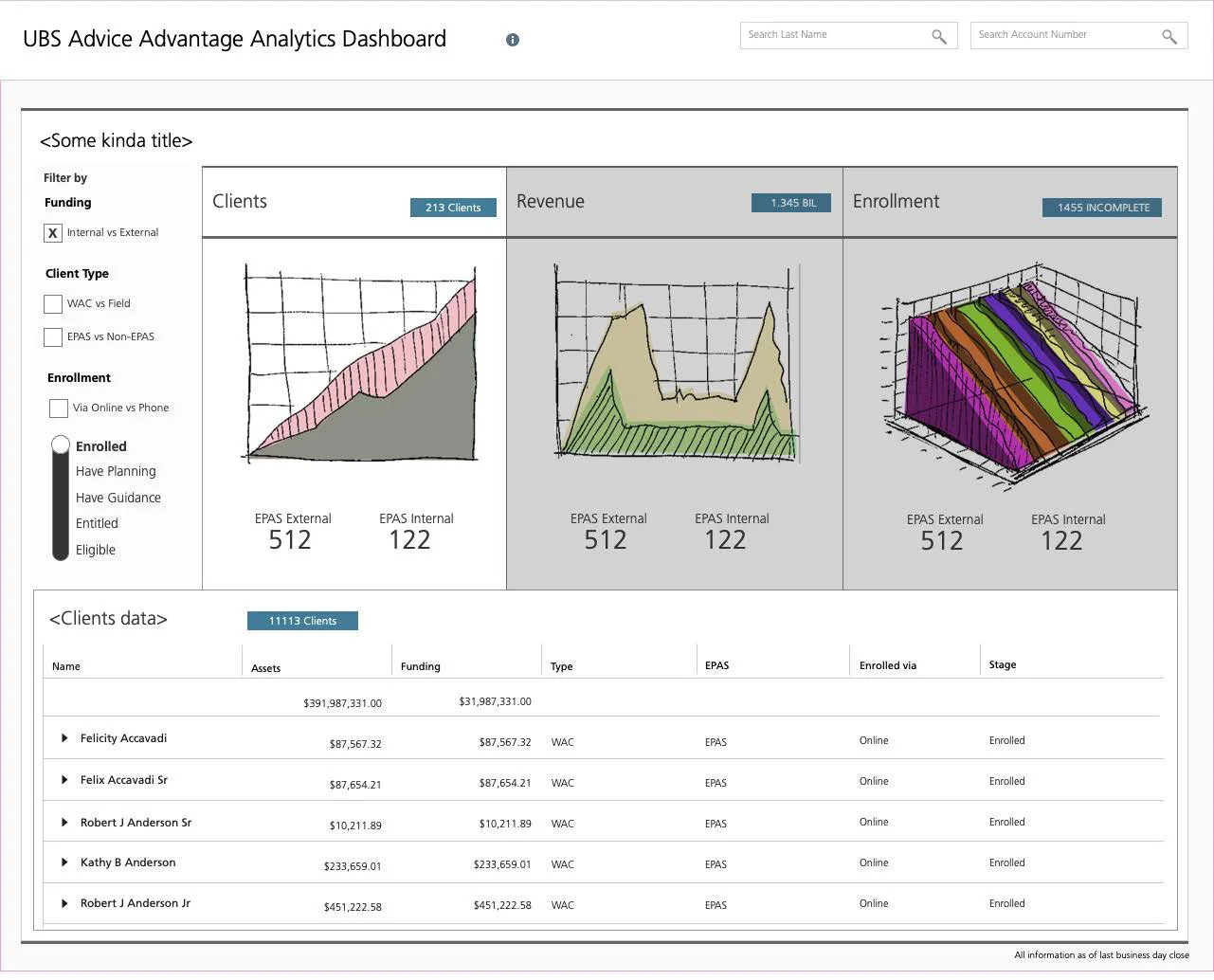

Effectiveness Data Visualization Dashboard

– Employee Facing Experience

End to end design process, including research and testing for desktop applications

Monitor Base for UBS Wealth Management Product Managers

THE PROBLEM

Financial analysts need a place to understand and entitle their affluent clients who would be eligible for the UBS Advice Advantage platform and its services.

OUR SOLUTION

The DAP Dashboard Experience allows FAs and CSAs to entitle any of their clients they feel would benefit from enrollment onto the UBS Advice Advantage Program. A User can search and find clients, understand a client's relationship to a household, and related clients, understand accounts related to a client, entitle any client they feel would benefit. The Field SigFig MVP will require a new set of pages to display UBS Advice Advantage details to the Field and Home Office users. Existing ConsultWorks applications may need to be modified to be a part of the Advice Advantage process. UBS Advice Advantage is UBS’s first platform designed with SigFig, an independent San Francisco-based wealth management technology company. The firms worked closely together to integrate the service within the UBS Online Services client website. The platform was also customized to incorporate UBS research and market views in the diagnostics and portfolio construction. We saw an opportunity to enhance the advisor-client relationship with an innovative product that meets our clients’ needs and maintains the critical elements and trust we have cultivated over decades.

LOW FIDELITY SKETCHES

What we learned from our discovery interviews:

“Having some overview of the usage of the product must be understood in the context of the users, and how they breakdown according to age, and more importantly, technological awareness”

Low Fidelity Wireframes

BUSINESS LINE MANAGERS USER INTERVIEWS

Interviewees: Doris D, Paul P, Jack M

Interviews Take Away Summary:

A strong agreement that the redesigned platform should primarily be an enabler of FA/Client relationships

“The Next Conversation” – enable better targeting of relevant topics to drive both quality and quantity of interactions

Equip the FA with an information advantage, pushing client education past plan creation

Clarification of “white glove” vs. “premium” terminology in the context of the platform

Premium experience should come by way of the advisor, not the platform

Not a self-serve business; FA already knows the client and his/her needs deeply, wealth management should be the filter

Role of UBS brand is to strengthen the relationship between firm and client

Delta of relationship, relevance, and product potentially results in a higher share of wallet for UBS

Mitigating calls for help and strengthening FA’s intellectual advantage work together to strengthen affinity for UBS

Custom-built-from-scratch Queries might be a functionality needed by some power-user level FA

Charts might not be a major need for day-to-day FA operations but could be useful at Supervisory levels

Entitling large groups of Households might not be needed

Confirmed it will be Client Level only

Categories/tiles of groups is an important concept

These categories need to be defined

Need to understand clients children, millennials in regards to WAC and prospective accounts, (get the children in the funnel, convert)

List view, FA selector mandatory needs verified

PROCESS MAPPING

We mapped out the back-end technical actions and their relevance to the front end processes. Enrollment, Contribution, and Withdrawal journeys were mapped. The major flows were for Enrollment, Contributions, and Withdrawal of Funds. we learned about the flow of data and the intricacies of how users did their tasks.

My contributions included:

LEADING THE DISCOVERY & RESEARCH

Product Strategy

User Persona Definition

UI/UX Assessment

Focus Groups

Content Audit

Taxonomy

Experience Maps

LEADING THE IDEATION

Design Workshops

Card Sorting

User Stories & Scenarios

Customer Journey Mapping

Usability Audit

Storyboarding

Rapid Prototyping

Information Architecture

Site Maps

Low Fidelity Wireframes

LEADING THE REFINEMENT

High Fidelity Wireframes

UI Visual Design

Clickable Interactive Prototypes

Pixel Perfect Comps

Design Assets

Visual Design Style Guide

Interaction Library Development

Technical Specifications